Incoming Amazon.com Inc. CEO Andy Jassy will take the reins of an e-commerce company that could see revenue more than double by 2025, largely driven by the company’s collection of retail and cloud computing services but also potential new business categories, analysts said.

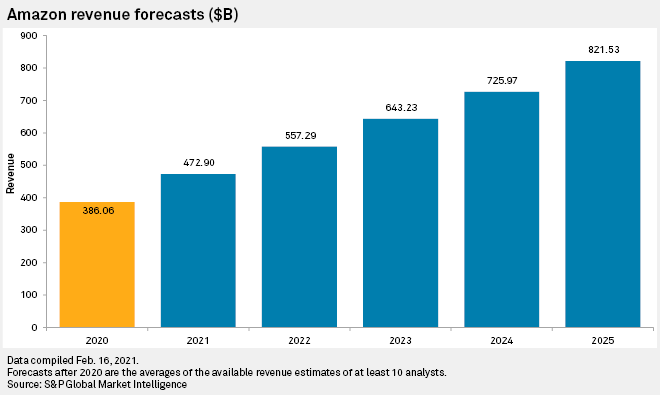

Consensus estimates call for Amazon’s total revenue to jump to about $821.53 billion in 2025, from $386.06 billion in 2020, according to S&P Capital IQ data.

If reached, that would eclipse the revenue of brick-and-mortar rival Walmart Inc., which analysts expect to report revenue of about $618.90 billion for its fiscal year that accounts for the 12 months ending in January 2026. Walmart is expecting sales and profits to slow over the next year as the company invests in its e-commerce strategy, automation, and supply chain.

The predictions indicate that Wall Street expects Amazon will remain a powerful tech and retail player for the years to come, even as it faces antitrust scrutiny and other challenges.

Cloud chief Jassy, who will take over as Amazon CEO in the third quarter, has not yet outlined his strategic growth priorities for the company. But he will face pressure to lead Amazon into its next stage of growth while tackling regulatory issues and exploring new revenue streams for Amazon’s sprawling, multifaceted operations, said Mark Shmulik, vice president and senior analyst with AB Bernstein.

“It’s different from leading a singular business and now managing a company that is pretty much in every single business you can ever imagine,” Shmulik said.

Stage is set

In many ways, the stage is set for Jassy, analysts said. He will be stepping into the CEO role at a time when Amazon has seen unprecedented growth due to investments in areas like grocery, logistics, and devices, which have diversified Amazon’s revenue streams over the past few years.

With the company’s retail businesses already well-established, Jassy’s job in large part is to continue that growth trajectory, said Michael Levine, senior research analyst for Internet and media at Pivotal Research Group. “His job [as future CEO] is a lot easier than it was five years ago,” Levine said.

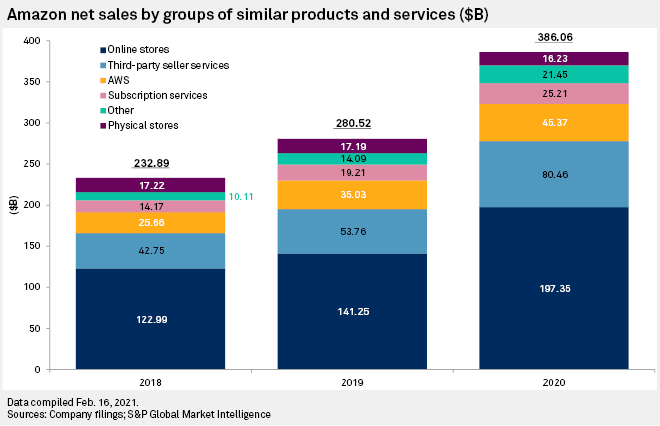

The acceleration of online shopping during the pandemic helped to fuel growth for Amazon’s online store sales, which grew to $197.35 billion in 2020, accounting for 51% of the company’s total revenue in 2020. That growth is likely to continue as consumers increasingly shift to shopping online, Levine said.

Meanwhile, Amazon Web Services Inc., the cloud computing unit that grew under Jassy’s leadership, will continue to drive a significant chunk of Amazon’s overall revenue as more companies move to the cloud.

Levine said Amazon’s sales moving forward will be largely driven by its high-growth retail services, including online store sales, third-party seller sales and Prime subscription revenue, which all feed off of one another. “It’s like one contiguous animal,” the analyst said. “One doesn’t exist without the other.”

Advertising revenue also has high growth potential. Amazon’s other category, which is made up primarily of advertising revenue, grew 64% year over year in the fourth quarter of 2020. Amazon CFO Brian Olsavsky said in a recent earnings conference call that Amazon’s ad revenue jump was driven by a recovery in ad spending and the company’s Prime Day shopping event, held in October 2020.

Sponsored search advertising that promotes products at the top of Amazon’s website is the dominant driver of ad revenue for Amazon today, and the company is starting to generate ad-supported revenue from its Prime Video channel, said Andrew Lipsman, principal analyst with eMarketer.

Levers to pull

Although much of Amazon’s growth trajectory has been established, Jassy has several other growth levers that he could pull, said Shmulik, of AB Bernstein.

Jassy will be under immense pressure to establish a “third leg” of business that could complement Amazon’s retail and cloud services, for instance, Shmulik said. “There’s certainly the pathway to get there, but it still requires making some pretty critical, important, focused decisions,” the analyst said.

Some options for fostering growth would be through Amazon’s online pharmacy platform, its fashion initiatives, or its Amazon Fresh grocery store footprint, Shmulik said.

Jassy could also work to grow Amazon’s market share internationally, but he will have to decide how aggressively the company will delve into markets like India and Latin America, where it would go against incumbent players like e-commerce company MercadoLibre Inc., Shmulik said. Walmart also has large investments in India, including its Flipkart e-commerce business.

“The decision of where to prioritize becomes increasingly important,” Shmulik said. “Outside of Europe, they are kind of playing catch up everywhere.”

Whatever business Amazon decides to pursue, the company likely will grow by diversifying into new lines of business as opposed to relying on organic growth from existing ones, said Kathy Gersch, chief commercial officer of change management firm Kotter.

Amazon’s philosophy is to take a “business need for themselves, solve it, and then scale it to solve business needs of other companies around the globe,” Gersch said. “I think they will be doing similar things with other categories, whether it’s logistics, delivery, drones, robotics.”